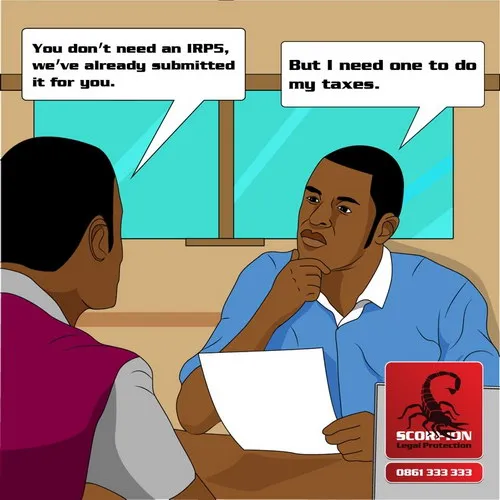

Insist that your employer provides you with your IRP5 so you can compare this to the one submitted to SARS. Your IRP5 describes your employment income and deductions as well as the PAYE tax already paid. Employers have 2 months from May to submit these to SARS and should begin giving them to employees at the beginning of June. If you don’t have it by July, you have a right to demand it. #StaySmart

(Please note: This is only general advice and should not be relied on solely. The law is complicated and there are many influencing factors that can change the above).